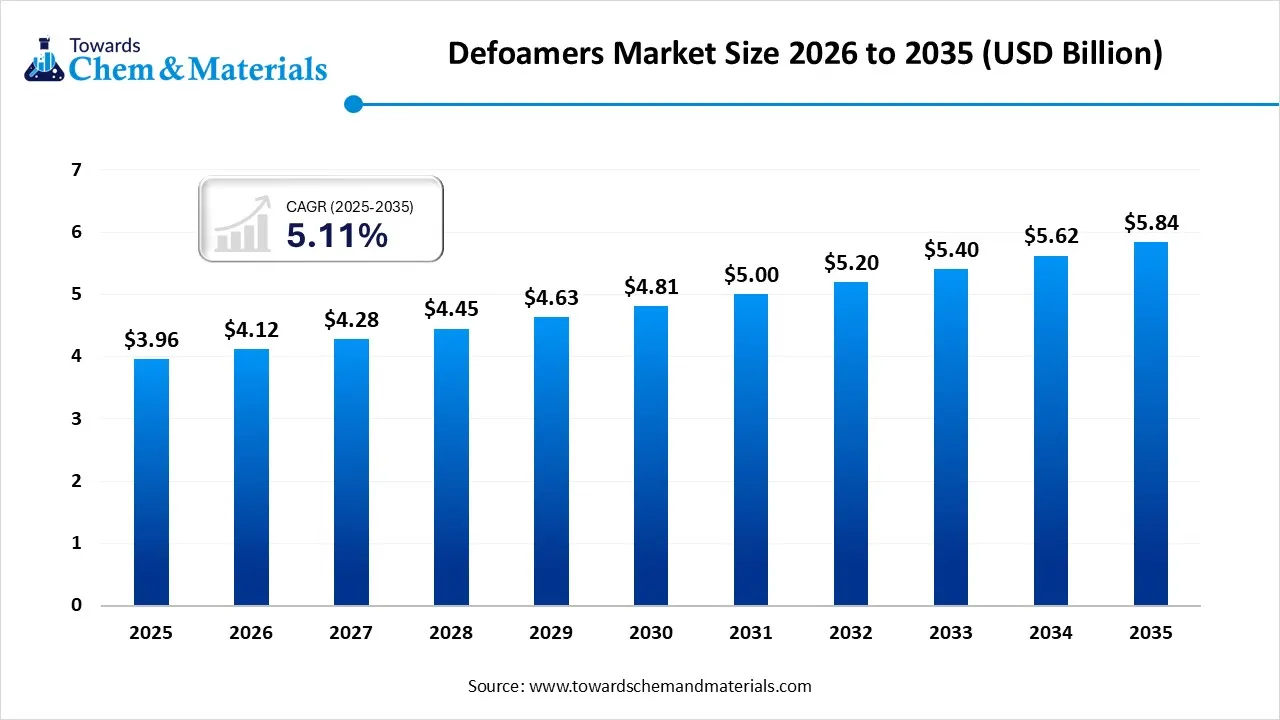

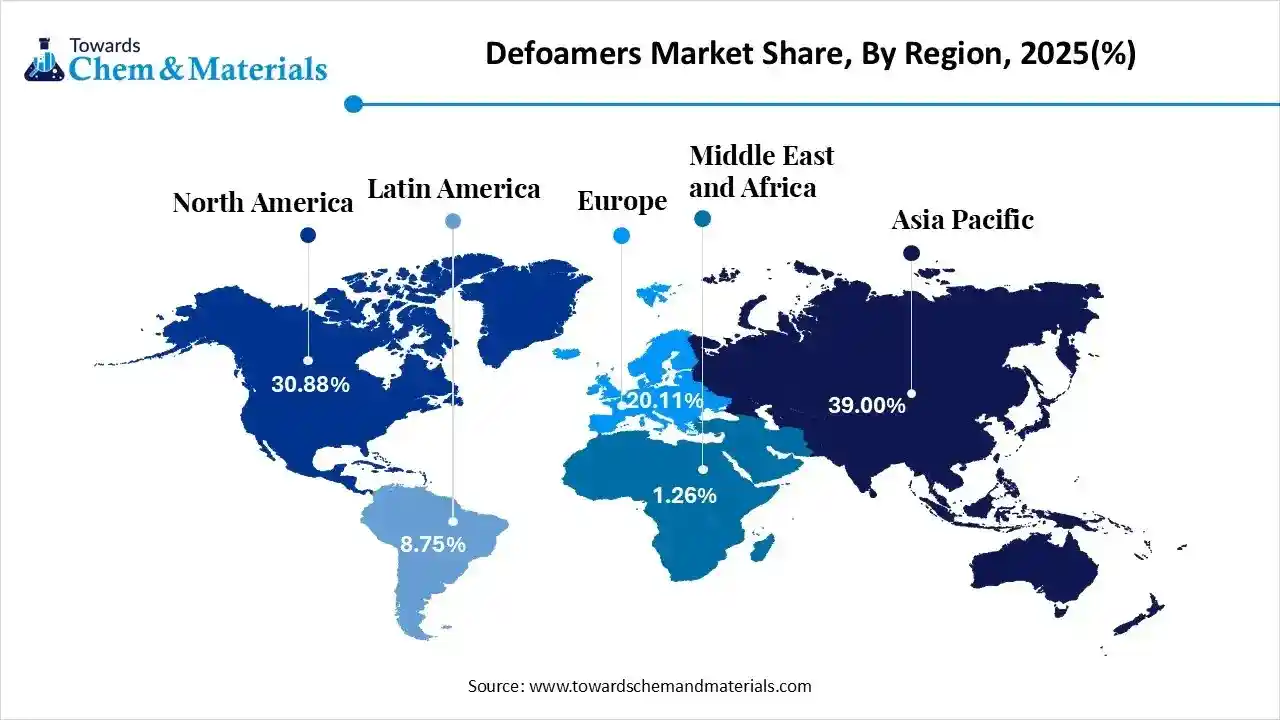

Ottawa, Feb. 16, 2026 (GLOBE NEWSWIRE) -- The global defoamers market size was valued at USD 3.96 billion in 2025 and is expected to be worth around USD 5.84 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.11% over the forecast period from 2026 to 2035. Asia Pacific dominated the defoamers market with the largest revenue share of 39% in 2025. The market is driven by stringent environmental & water mandates, sustainability targets, technological shift and industrial expansion. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5677

Defoamers Market Report Highlights

- Asia Pacific defoamers market held the largest revenue share of 39% in 2025.

- By region, North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be driven by stringent environmental regulations and ongoing technological advancements.

- By type, the silicone-based defoamers segment dominated the market and accounted for the largest revenue share of 36% in 2025.

- By type, the polyether siloxane-based defoamers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the surge in industrial production.

- By medium, the emulsion-based segment led the market with the largest revenue share of 41% in 2025.

- By application industry, the pulp & paper segment dominated the market and accounted for the largest revenue share of 25% in 2025.

- By function, the surface foam suppression segment led the market with the largest revenue share of 46% in 2025.

- By distribution channel, the direct sales segment dominated the market and accounted for the largest revenue share of 56% in 2025.

- By formulation compatibility, the aqueous systems segment dominated the market by holding 61% market share in 2025.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Defoamers: Maximize Processes, Minimize Foam

Defoamers are high-performance chemical additives crucial for enhancing industrial efficiency by preventing foam during manufacturing. They design to reduce surface tension to collapse air bubbles, preventing equipment overflow and damage, ensuring accurate measurements, and maintaining high speeds. The market is driven by industries like wastewater treatment, pulp and paper, paints, and food processing. As industries adopt sustainable practices with the innovation of biodegradable, VOC-free, and concentrated formulations aligned with environmental regulations.

Comparison of Defoaming Agents

Defoaming agents are classified based on their composition and application suitability. Below is a tabular comparison of the key types of defoamers:

Type of Defoamer

Composition

Best Used In

Key Advantages

Oil Based

Carriers like mineral oil, vegetable oil, or white oil with hydrophobic particles (e.g., wax, silica).

Pulp & Paper, Wastewater Treatment.

Effective at breaking stable foam, cost-efficient.

Silicone Based

Polydimethylsiloxane (PDMS) or silicone emulsions with hydrophobic silica.[2]

Paints & Coatings, Oil & Gas, Food Processing.

Highly effective at low dosages, heat-stable, long-lasting.

Water Based

Water with dispersed oils, waxes, or surfactants.

Wastewater Treatment, Food & Beverage.

Eco-friendly, easy to disperse, food-safe variants available.

Powdered

Silicone-based or oil-based defoamer on a carrier like silica.

Cement, Detergents, Powdered Food Processing.

Suitable for dry formulations, easy storage.

EO/PO Based

Polyethylene oxide (EO) and polypropylene oxide (PO) block copolymers.

Paints, Coatings, and Metalworking Fluids.

Good dispersibility, effective at low concentrations.

Alkyl Polyacrylates

| Polymer-based defoamers. |

Adhesives, High-Shear Processes.

Stable under high-shear conditions, long-lasting defoaming action.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5677

How to Optimise Defoamer Performance

To get the best results from defoamers, it’s essential to use them strategically. Start by choosing the right type based on your process conditions—factors like temperature, pH, and foam stability matter. Always add defoamers at the right stage, whether during mixing, processing, or post-production, to maximise efficiency while minimising waste. Proper dosing is key—too little won’t control foam, and too much can lead to surface defects or contamination.

A common mistake is adding defoamers too late when the foam has already built up, making control harder and less effective. Incompatible defoamers can also cause separation issues, reducing performance. Another pitfall is improper dispersion—some defoamers need thorough mixing to work correctly. By following best practices and avoiding these missteps, you can optimise defoamer performance, reduce costs, and keep operations running smoothly.

“To successfully predict the antifoam addition in a proactive manner for an industrial data set (about half a million instances for 163 batches), we use a genetic algorithm called TPOT (Tree-based Pipeline Optimization Tool), and to build antifoam profiles, we use exploratory time-series analysis. Through this work, we have successfully demonstrated the following: (1) the ability of automated machine learning (AML) to predict AFA addition for multiple strains of microorganisms using large-scale industrial fermentation data set and (2) the edge of data-guided antifoam profiles based on time series.” – Industrial & Engineering Chemistry ResearchVol 61/Issue 15

Chemistry of Defoamers

Which defoamer is most appropriate for a given solution depends on several factors, including the chemical composition & physical properties of the foaming solution, the method of foam generation and the type of foam present.

Typically, defoamers are formulated around a carrier fluid, which may be a hydrocarbon, silicone oil, vegetable oil, synthetic polymer, etc. Active ingredients, which help with spreading or destabilizing foam, can include waxes, metal salts, silicas or other hydrophobic particles. An emulsification system can be incorporated to optimize spreading and compatibility of the defoamer to a given foaming system and depending on the chemistry, stabilizing agents such as cellulosic or acrylic thickeners may be added to improve shelf stability.

Crucible maintains an extensive portfolio of defoamer chemistries. The following represent some of the broader categories of defoamer and their common uses:

Silicone & Organo-Silicone Defoamers

Silicone & organo-silicone defoamers are highly efficient and broadly effective in a wide variety of applications. These products are based on silicone oils (polydimethylsiloxane or modified siloxanes), often with hydrophobic silica dispersed in solution. Silicone oils have a very low surface tension, which contributes to rapid spreading at the gas-liquid interface and facilitating the weakening of the foam films and penetration of the bubble wall.

Crucible supplies these types of products as 100% active silicone compounds, dispersions, or as emulsions, which are readily dispersible in aqueous systems.

Non-Silicone Defoamers

Non-silicone defoamers can be further broken down into several categories. The most broadly used are mineral oil-based due to their optimal performance and lower cost. Non-silicone defoamers are also formulated with vegetable oils, white oils, esters, fatty alcohols, synthetic polymers, etc., depending on the characteristics, compatibility, and requirements of each foaming system. These defoamers often include hydrophobic particles (e.g. silicas, waxes, etc.) to boost performance and may be supplied as insoluble or partially soluble dispersions, emulsions or self-emulsifiable, 100% active liquids.

Within this category, Crucible also supplies VOC, APE (alkylphenol ethoxylate) and silicone-free defoamers with our Foamkill™ V product line. These products are optimal replacements for traditional mineral-oil based products used in adhesives, defoamers for paint and coatings, and numerous other applications.

Private Industry Investments for Defoamers:

- Arkema’s Acquisition of Ashland’s Business: This 2024 deal integrated Ashland's high-performance defoamer technologies into Arkema’s global specialty chemicals portfolio.

- Clariant’s Specialty Startup Acquisition: In late 2024, Clariant acquired a niche startup to bolster its offerings in biodegradable and high-performance industrial defoaming agents.

- BASF’s Turkey Expansion: BASF invested in a new production line at its Dilovasi plant to increase the supply of its Foamaster and Foamstar brands to the Middle East and Africa.

- PennWhite India’s New Plant: PennWhite is building a dedicated manufacturing facility in Chennai to localize production and serve the rapidly growing Asian industrial market.

- Evonik’s Bio-Based R&D: Evonik has directed significant capital toward developing next-generation defoamers, such as TEGO Foamex, which utilizes 50% bio-based materials.

- Wacker Chemie’s Food-Grade Line: Wacker invested in a sustainable line of silicone-based defoamers specifically designed to meet strict regulatory standards for the food and beverage industry.

- Shin-Etsu’s Supply Chain Partnership: Shin-Etsu entered into a strategic agreement with an Indian fermentation firm to localize the manufacturing of specialized antifoam agents.

- Arkema’s Acquisition of ArrMaz: Arkema purchased ArrMaz from a private equity firm to acquire specialized fatty acid-based defoamer assets used primarily in mining and fertilizer production.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5677

Defoamers Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 3.96 billion |

| Revenue forecast in 2035 | USD 5.05 billion |

| Growth rate | CAGR of 5.0% from 2025 to 2035 |

| Base year for estimation | 2025 |

| Historical data | 2021 - 2025 |

| Forecast period | 2026 - 2035 |

| Quantitative units | Volume in kilotons, revenue in USD million and CAGR from 2026 to 2035 |

| Report coverage | Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Type, By Medium/Formulation, By Application Industry, By Function, By Distribution Channel, By End-Use Formulation Compatibility, By Region |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France, Finland; Sweden; Italy; Spain; Benelux; China; India; Brazil; Chile; Peru |

| Key companies profiled | Kemira Oyj; Air Products and Chemicals, Inc.; Ashland Inc.; Bluestar Silicones International; Dow Inc.; Evonik Industries AG; Wacker Chemie AG; Shin-Etsu Chemical Co., Ltd.; BASF SE; Elementis PLC; Clariant AG; KCC Basildon; Eastman Chemical Company; Synalloy Chemicals; Tiny Chempro; Trans-Chemco, Inc. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Defoamers Market Dynamics

- Stringent Regulatory Framework: The global shift towards clean water is driving the use of defoamers in aeration tanks and membrane bioreactors. The stringent regulation enables innovation in bio-based deformers to meet sustainability goals.

- Adoption in Industrial Grade: The rising demand for food-grade defoamers, vegetable-oil-based formulation, non-silicon defoamers, and specialised defoamers in semiconductor and bio-pharmaceuticals is shaping these trends.

Driver

Rapid Urbanization and Industrialization

- As the global population increases, that driving the rise in construction infrastructure, where defoamers play a key role to prevent air bubble while rapid industrialization is driving the consumption of foam control agents in various applications like paints, textiles, and coatings.

Restraints

High R&D cost and Raw Material Volatility

- A significant capital investment is needed to develop advanced sustainable products to meet strict regulation standards that limit the growth and slow the expansion. The volatility in the prices of petroleum-based raw materials is also restraining the market expansion.

Opportunity

Nanoparticle-Based Defoamers Application

- The researchers are focused on the development of nano-based defoamers that create a massive opportunity for nano-emulsion defoamers and nanoparticle-based anti-foam agents that offer superior efficiency and reduce chemical usage. The nano-defoamers align with green chemistry that lowers the chemical oxygen demand in wastewater by meeting sustainability goals.

Empowering Defoamers Industry with Smarter and Cleaner Solution.

- Technology advancement includes AI-driven molecular modelling and automated screening for designing tailored additives. The integration of real-time sensors and predictive analytics to optimize dosage and reduce waste. Additionally, Innovations in nanotechnology and smart delivery systems create more stable, eco-friendly formulations of defoamers that enhance efficiency and lower environmental impact.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5677

Defoamers Market Segmentation Insights

Type Insights

How Did the Silicone-Based Defoamers Segment Dominate the Defoamers Market?

The silicone-based defoamers segment dominated the market, valued for fast, precise foam elimination, chemical inertness, and superior thermal stability, effective in demanding environments. Their low surface tension allows rapid bubble rupture at low concentrations by reducing chemical footprint and ensuring safety and purity for sensitive applications.

The polyether siloxane-based defoamers segment is anticipated to grow fastest due to its hybrid technology by combining silicone efficiency with polyether solubility, offering high-precision, self- emulsifying agents suitable for complex systems. Additionally, their flexibility to perform under extreme conditions, providing rapid foam control and long-lasting suppression, boosts product quality with superior compatibility and operational efficiency.

Medium Insights

Which Medium Segment Dominates the Defoamers Market?

The emulsion-based segment maintains its market dominance, characterised by its versatile delivery system and dispersing active anti-foam agents into stable aqueous carriers, for uniform foam control in water-heavy industrial processes. The emulsions offer operational cost-effectiveness, compatibility with waterborne systems, and environmentally friendly applications, maintaining leadership in process stability and product reliability in the manufacturing landscape.

The granular segment offers significant growth during the projected period, driven by solid-state processing and dry-blend applications. Granular is designed by encapsulating active foam-control agents onto solid carriers for controlled release. These are ideal for powder products like detergents, agricultural chemicals, and construction materials, offering stability, precise dosing, ease of handling, and long shelf-life, essential for non- liquid foam suppression needs.

Application Industry Insights

How did the Pulp & Paper Segment Dominate the Defoamers Market?

The pulp and paper segment leads in the market due to the high-velocity, foam-intensive nature of modern papermaking and technological innovation. Advanced defoaming agents enhance drainage, prevent equipment fouling, and produce uniform sheets by maintaining operational efficiency. Additionally, the circular economy becomes key, innovations focus on sustainable packaging and chemically minimised formulations by protecting recyclability and water quality. This segment is essential to global foam control, driving innovation and large-scale use.

The paints & coatings segment is an emerging segment projected to grow at a CAGR between 2026 and 2035, due to its innovation and its crucial role for aesthetics and durability. As waterborne systems rise, boosting the demand for defoaming agents that eliminate micro- foam and surface defects, ensuring a perfect finish. The shift to green chemistry in this segment leads the industry to low- emission, bio- derived formulations that uphold high standards without sacrificing performance. This segment balances rapid air release and long- term film stability, maintaining its vital role in foam control technology.

Function Insights

Why did the Surface Foam Suppression Segment Lead the Defoamers Market?

Surface foam suppression is the key segment in the market, providing instant macro- foam knockdown to prevent overflows, measurement errors, and equipment damage. By using active agents with ultra- low surface tension rapidly destabilize and rupture foam at the surface, critical for water treatment, chemical, and food production. As the industrial shift towards automated manufacturing drives demand for these high-power surface suppressants remains essential for uptime and operational performance.

The deaeration agent segment is experiencing the fastest growth in the market during the projected period. Represents a highly precise technology that targets the removal of micro- bubbles within liquids. They promote bubble coalescence and help air escape, crucial for high-viscosity applications such as automotive coatings and adhesives. As waterborne and high-solids formulations advance, demand for these agents increases to ensure product quality, finishes, and mechanical strength. They are connecting the gap between processing and finished product quality, remaining fundamental in advanced industrial manufacturing.

Distribution Channel Insights

How did the Direct Sales Segment hold the Largest Share of the Defoamers Market?

The direct sales segment is vital for distributing complex, technical products, offering tailored chemical solutions and expert technical support to ensure appropriate application, troubleshooting, supply chain resilience, and compliance. This model enhances operational efficiency and maintains close industry relationships by enabling a direct-to-consumer approach and long-term partnership

The online platforms segment is an emerging segment projected to grow at a CAGR during the forecast period. Transforming defoamer distribution, offering a rapid, transparent digital interface for brands to access diverse chemical data, real-time certifications, and products directly by integrating with modern infrastructure. This channel enables quick sourcing, especially for small or regional buyers, fostering an efficient supply chain and data- driven procurement landscape.

Formulation Compatibility Insight

Which Formulation Compatibility Segment Dominates the Defoamers Market?

The aqueous systems segment maintains its market dominance due to a global shift toward waterborne technologies. As manufacturers move away from solvents to meet environmental standards that lead to foam control for paints, coatings, and water treatment. Aqueous-compatible defoamers are crucial, offering dispersibility and high bubble suppression. This system, enabling sustainable, fast manufacturing, positions this segment as essential in modern chemical processing.

The high-viscosity systems segment offers significant growth during the projected period, driven by a transition to solvent-free formulations. Industries like automotive, aerospace, and construction use thicker materials to meet strict eco-standards and improve durability, increasing the need for specialized deaeration agents to achieve entrapped micro-foam. Additionally, these advanced solutions ensure structural integrity, maintaining the segment’s role as a driver of innovation.

Regional Insights

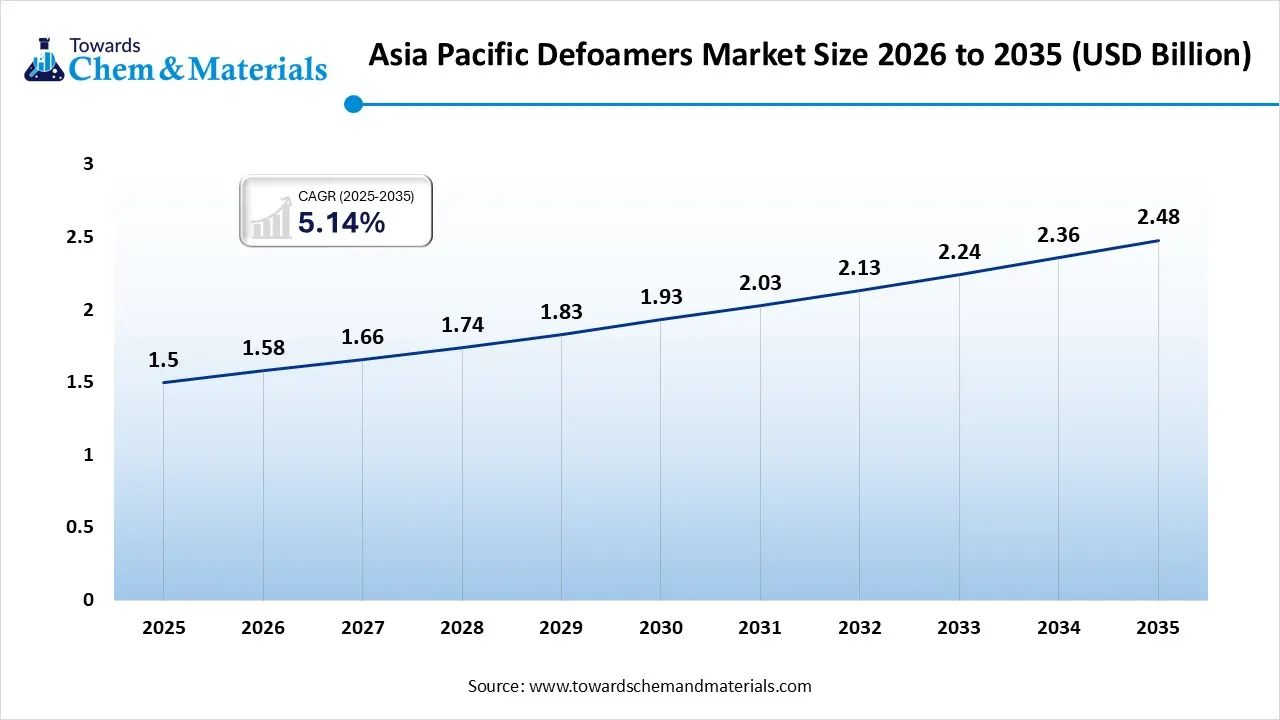

The Asia Pacific defoamers market size accounted for USD 1.50 billion in 2025 and is forecasted to hit around USD 2.36 billion by 2034, representing a CAGR of 5.14% from 2025 to 2034. Asia Pacific dominated the defoamers market with 39% market share in 2025, and the region is expected to sustain this position during the forecast period.

How did Asia Pacific Dominate the Defoamers Market?

The Asia-Pacific market leads globally in foam control innovation, which is vital for industrial efficiency and manufacturing. It thrives through infrastructure growth and process improvements in paints and coatings, focusing on silicone advancement and water-based technology to ensure seamless production and product quality. The region is moving toward green chemistry and low- emission formulation with sustainability standards, balancing industrial output with ecological responsibility, strengthening its position as a transformative global hub.

China Defoamers Market Trends

China’s market is growing as expanding industrial activity across paints, coatings, adhesives, wastewater treatment and food processing drives the need for efficient foam control additives. There's an increasing shift towards eco-friendly, biodegradable and low-VOC defoamers, including water-based and silicone-free formulations, in response to stricter environmental regulations and sustainability priorities.

Why is North America the Fastest-Growing Region in the Defoamers Industry?

The North American market is driven by an emphasis on technical excellence and environmental sustainability. It adopts high-performance, bio-based, low-emission, and sustainable formulations to meet strict regulations, with a strong focus on R&D, particularly in pharmaceuticals, food processing, and water treatment, making it a leader in green foam control solutions and high-performance chemical additives

U.S. Defoamers Market Trends

The U.S. market is expanding as growing industrial production in paints, coatings, adhesives, and wastewater treatment increases demand for effective foam control solutions. There is a clear shift towards environmentally friendly, low-VOC, and silicone-free formulations driven by stricter regulatory standards and sustainability goals.

Top Market Players in Defoamers Market & Their Offerings:

- BASF SE: Provides Foamaster and Foamstar lines, featuring mineral oil and silicone-based solutions for water-based coatings and adhesives.

- Dow Inc.: Supplies DOWFAX and XIAMETER brands, offering polyglycol and silicone agents for food processing, oil and gas, and industrial cleaning.

- Kemira Oyj: Specializes in oil, water, and ester-based defoamers optimized for pulp, paper, and wastewater treatment applications.

- Shin-Etsu Chemical Co., Ltd.: Produces diverse silicone-based agents in oil, emulsion, and powder forms for the chemical, textile, and fermentation industries.

- Air Products and Chemicals, Inc.: Developed the Airase line of vegetable and mineral oil-based defoamers, now primarily managed under Evonik’s portfolio.

- Evonik Industries AG: Offers the TEGO Foamex brand, focusing on high-performance siloxane-based and emulsion defoamers for printing inks and architectural coatings.

- Elkem ASA: Manufactures SILCOLAPSE and BLUESIL silicone emulsions and compounds for demanding oil, gas, and food-grade applications.

- Clariant AG: Provides the D-FOAM-R series, featuring silicone-free dry and liquid formulations for construction materials, metalworking fluids, and industrial cleaners.

More Insights in Towards Chemical and Materials:

- Textile Chemicals Market Size to Surge USD 50.84 Billion by 2034

- Oil & Gas Market Size to Reach USD 8.79 Trillion by 2034

- Bioplastic Textiles Market Size to Hit USD 34.53 Billion by 2035

- Technical Textiles Market Size to Surpass USD 481.15 Bn by 2035

- Geotextiles Market Size to Hit USD 28.90 Billion by 2035

- Liquid Hydrogen Market Size to Hit USD 91.21 Billion by 2035

- Natural Gas Liquid Market Size to Hit USD 50.06 Billion by 2035

- Industrial Liquid Waste Management Market Size to Surpass USD 132.45 Billion by 2035

- Liquid Fertilizers Market Size to Worth USD 4.93 Billion by 2035

- Liquid Paints & Coatings Market Size to Surge USD 246.39 Bn by 2035

- Liquid Crystal Polymers Market Size to Hit USD 6.73 Billion by 2034

- Liquid Silicone Rubber Market Size Hits $ 8.06 Bn at 8.55% CAGR

- Liquid Paints & Coatings Market Size to Surge USD 246.39 Bn by 2035

- Automotive Paints & Coatings Market Size to Hit USD 48.22 Bn by 2035

- Water-Based Solvent Paints Market Size to Surpass USD 153.39 Bn by 2035

- Paints and Coatings Market Size to Hit USD 348.04 Bn by 2034

- Oil & gas infrastructure Market Size to Reach USD 1,377.87 Bn by 2034

- U.S. Oil & Gas Market Size to Hit USD 2.24 Trillion by 2034

- European Paints & Coatings Market Size to Hit USD 54.27 Bn by 2034

- U.S. Paints & Coatings Market Size to Reach USD 50.23 Billion by 2034

- Cement Paints Market Hits USD 8.11 Bn at 3.25% CAGR [2025-34]

- Europe Oil & Gas Infrastructure Market Size to Hit USD 140.09 Bn by 2034

- Asia Pacific Oil & Gas Infrastructure Market Size to Reach USD 365.90 Bn by 2034

- Asia Pacific Oil & Gas Market Size to Hit USD 2.79 Trillion by 2034

- U.S. Oil & Gas Infrastructure Market Size to Hit USD 147.32 Billion by 2034

- Bio-Based Textiles Market Size to Reach USD 54.21 Billion in 2025

- Antimicrobial Textile Market Size to Hit USD 25.55 Billion by 2035

- Textile Colorant Market Size to Hit USD 18.46 Billion by 2035

- Smart Textile Polymers Market Size to Hit USD 9.63 Million by 2035

- AI in Textile Market Size to Hit USD 68.44 Bn by 2035

- Europe Textile Market Size to Worth Around USD 410.94 Bn by 2034

Defoamers Market Top Key Companies:

- BASF SE

- Evonik Industries AG

- Dow Inc.

- Kemira Oyj

- Shin-Etsu Chemical Co., Ltd.

- Air Products and Chemicals, Inc.

- Ashland Global Holdings Inc.

- Clariant AG

- Wacker Chemie AG

- Huntsman Corporation

- Momentive Performance Materials Inc.

- Elkem ASA

- Solvay S.A.

- Elementis PLC

- BYK-Chemie GmbH (ALTANA Group)

- Munzing Chemie GmbH

- SAGITTA (KCC Corporation)

- Kao Corporation

- Resil Chemicals Pvt. Ltd.

- King Industries, Inc.

Recent Developments

- In November 2024, Evonik Coating Additives launched two new defoamers, TEGO Foamex 16 and TEGO Foamex 11, designed to enhance sustainability and performance in waterborne architectural coatings. TEGO Foamex 16 targets low to medium PVC coatings, and TEGO Foamex 11 is optimized for high PVC coatings.

- In November 2023, BASF expanded its defoamer production capacity at its Dilovasi plant in Türkiye with a new production line. This increase enables better response to the growing demand for Foamaster and Foamstar products across South-East Europe, the Middle East, and Africa.

- In April 2024, Evonik launched new sustainable TEGO® Foamex 16 and TEGO® Foamex 11 defoamers for architectural coatings. This product improves sustainability and defoaming efficiency.

Defoamers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Defoamers Market

By Type

- Silicone-based Defoamers

- Oil-based Defoamers

- Water-based Defoamers

- Powder-based Defoamers

- EO/PO-based Defoamers

- Polyether Siloxane-based Defoamers

- Alkyl Polyacrylate-based Defoamers

By Medium/Formulation

- Liquid

- Solvent-based

- Emulsion-based

- Granular

- Paste/Gel

By Application Industry

- Pulp & Paper

- Paints & Coatings

- Water & Wastewater Treatment

- Food & Beverage

- Oil & Gas

- Pharmaceuticals

- Textiles

- Agrochemicals (Pesticides, Fertilizers)

- Adhesives & Sealants

- Chemical Manufacturing

- Metalworking Fluids

By Function

- Surface Foam Suppression

- Entrained Air Removal

- Deaeration Agent

By Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Online Platforms

By End-Use Formulation Compatibility

- Aqueous Systems

- Non-aqueous (Solvent-based) Systems

- High-viscosity Systems

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5677

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/